About NextGen Lending 2016

After a hugely successful 2015 event, the Next Generation Lending conference returns this August in Sydney with a stronger focus on emerging trends in the retail sector and the disruptive changes shaping the face of lending.

The conference once again brings together leaders and senior managers from the banking and the NBFS sectors for a high level discussion on the latest developments that are driving the market dynamics in retail and commercial lending. They will analyse the new opportunities for improved customer experience, digital innovation and non-traditional revenue streams to improve profitability, capture new market share and retain customers.

With alternative lending deal volumes on the rise, and the race for financial institutions to deliver a seamless digital lending experience to customers, key industry leaders will discuss how they are overcoming the frictions in spite of the regulatory environment, while optimising customer engagement and how they are capitalising on new technologies in 2016.

Who will you meet?

Consumer finance executives from areas of expertise such as: mortgage origination, direct lending, marketing, IT, digital, strategic development, product development, customer service, customer experience, business development and innovation strategy.

You will have the opportunity to network with chief executives of the following functions:

You will have the opportunity to network with chief executives of the following functions:

- Lending

- Marketing

- Information Technology

- Digital Channels and Digital Strategy

- Distribution

- Business Transformation

- Mobile Lending

- Third Party Lending

- Home Loan Product Development

- Customer Experience

- Business Analytics

- Portfolio Optimisation

From the following types of organisations:

- Retail Banks

- Credit Unions

- Building Societies

- FinTechs

- Non-Bank Lenders

- Alternative Financial Services

- Institutional Investors

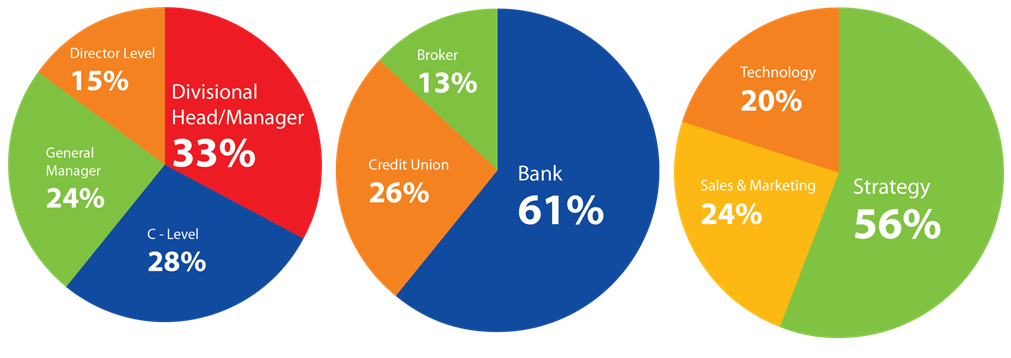

In 2015, the NextGen Lending conference attracted delegates from the following roles, companies and sectors:

Why attend?

Some of the key benefits of attending Next Generation Lending 2016:

- Understand the changing role of banks in light of emerging lending models and technologies

- Explore the new lending platforms and how they are transforming credit evaluation and loan origination as well as opening up consumer lending to non-traditional sources of capital

- Discover how next-gen lenders around the world are addressing the concerns around security with API adoption in their digitisation strategies

- Gain insights from best practices in acquiring the “right” level of friction in the lending model to balance risk and customer demands

- Identify the market trends in lending that are driving customer loyalty and engagement

- Learn to build the next-gen team to be ready for a digital customer experience

Addressing the key challenges facing lenders:

- Leading the digital initiative in an industry undergoing disruption – aligning smart investments in new technology with an innovation leadership strategy and embedding it into the organisational culture

- Achieving seamless customer experience – getting the “right” level of friction in the lending model to balance risk and customer demands

- Connecting the loan origination process with customer relationship management solutions – eliminating the fragmented approach to digitisation to achieve a truly end-to-end digital process with focus on the customer

- Regulatory outlook – getting first-hand information on data policy settings and credit conditions in the pipeline that will impact the lending space

- Mastering the latest credit risk management techniques to create the most effective response to borrower behaviour patterns – using data to support the credit decision, risk profiling and pricing

- Keeping the customer relationship alive beyond the settlement cycle - how lenders really leverage their data in a contextual manner to optimise borrower engagement